Assessing the Disadvantages of Return of Premium Life Insurance

While Return of Premium (ROP) life insurance offers the appealing proposition of premium refunds if the policyholder outlives the term, it is imperative to scrutinize its less favorable aspects. The allure of receiving back what one has paid in does not come without cost—namely, higher premiums, limited investment opportunities, and potentially hefty penalties for early surrender.

These drawbacks, coupled with inflexibility in policy adjustments, may greatly detract from the product’s value for certain individuals. As we navigate the intricacies of ROP life insurance, it becomes clear that understanding its disadvantages is vital for making an informed decision that aligns with one’s financial goals and life circumstances.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Key Takeaways

- Higher premium costs make it less affordable for many and may outweigh potential benefits.

- Limited investment growth as focus is on returning premiums rather than wealth generation.

- Early surrender penalties can lead to significant financial loss and forfeited refunds.

- Not ideal for short-term coverage needs, better suited for long-term financial planning.

- Lack of flexibility with modifications to coverage amounts and policy terms.

Higher Premium Costs

Return of premium life insurance is distinguished by its markedly higher premium costs when compared to traditional term life insurance, primarily due to the insurer’s obligation to refund premiums. This refund responsibility markedly drives up the cost, making these policies less affordable for many individuals. For those with average health, the increased premiums may seem prohibitive, questioning the additional cost’s worth, especially if they outlive the policy term.

While the promise of receiving all paid premiums back if one outlives the policy term can be appealing, it’s crucial to weigh whether the higher premium costs justify this potential benefit. This consideration is crucial for anyone seeking a sense of financial security and belonging, as the less affordable nature of these policies could limit accessibility for some.

Limited Investment Growth

While higher premium costs present one set of challenges, the limited investment growth potential of return of premium life insurance also merits attention. ROP insurance prioritizes the return of paid premiums over investment growth, leading policyholders to potentially miss out on significant investment gains.

Unlike other financial instruments designed for wealth accumulation, ROP policies offer limited opportunities for higher investment returns. This focus on simply returning the paid premiums rather than generating wealth means that individuals searching for growth opportunities may find ROP insurance lacking.

The potential for making one’s money work harder and achieve greater financial milestones is constrained, making ROP insurance an option more suited for those prioritizing security over the potential for substantial investment growth.

Early Surrender Penalties

Facing early surrender penalties, policyholders of return of premium life insurance might find themselves forfeiting a substantial part of the premiums they have diligently paid. This unfortunate situation can arise from a variety of scenarios that underscore the drawbacks of early policy termination:

- Surrender penalties can lead to a significant financial loss, erasing the potential for any premium refund.

- Terminating the policy early may result in the complete forfeit of the potential refund, negating the policy’s financial benefits.

- The surrender value of the policy might be much lower than the total premiums paid, due to penalties.

- Early surrendering often negates the financial benefits, leaving policyholders with a lower surrender value than expected, turning what was meant to be a safety net into a financial setback.

Not Ideal for Short-Term

For individuals with immediate or brief coverage needs, return of premium (ROP) life insurance may not present the most advantageous option. This is because ROP insurance is tailored for those with longer-term coverage goals, requiring policyholders to maintain their policy for the full term to benefit from a premium refund.

Consequently, those seeking short-term financial protection might find traditional term life insurance a better fit, as it is designed to meet immediate benefits without the need to wait for a refund of premiums. The essence of ROP insurance, focusing on the return of premiums over an extended period, does not align well with the insurance goals of individuals with short-term insurance needs.

Lack of Flexibility

How does the lack of flexibility in return of premium life insurance policies affect policyholders seeking to adjust their coverage? This limitation can present significant challenges for individuals as their financial needs and circumstances evolve.

- Inability to easily modify coverage amounts during the policy term restricts policyholders from adapting to life’s changes.

- Limited options to adjust the policy terms once established, making it harder to navigate financial changes.

- Restrictions on changes to coverage or premium amounts can hinder the ability to tailor policies as needed.

- Compared to other life insurance policies, return of premium policies offer less room to customize features through riders or adjustments.

This lack of flexibility can make it challenging for policyholders to align their insurance with changing life circumstances, potentially impacting their financial well-being.

Potential Loss of Value

One significant drawback of Return of Premium (ROP) life insurance is its potential to yield lower financial returns compared to alternative investment vehicles. This potential loss of value is a core concern for those seeking to maximize their financial legacy. The allure of receiving refunds on premiums paid if the policyholder outlives the term can be overshadowed by the loss of potential earnings from other investments.

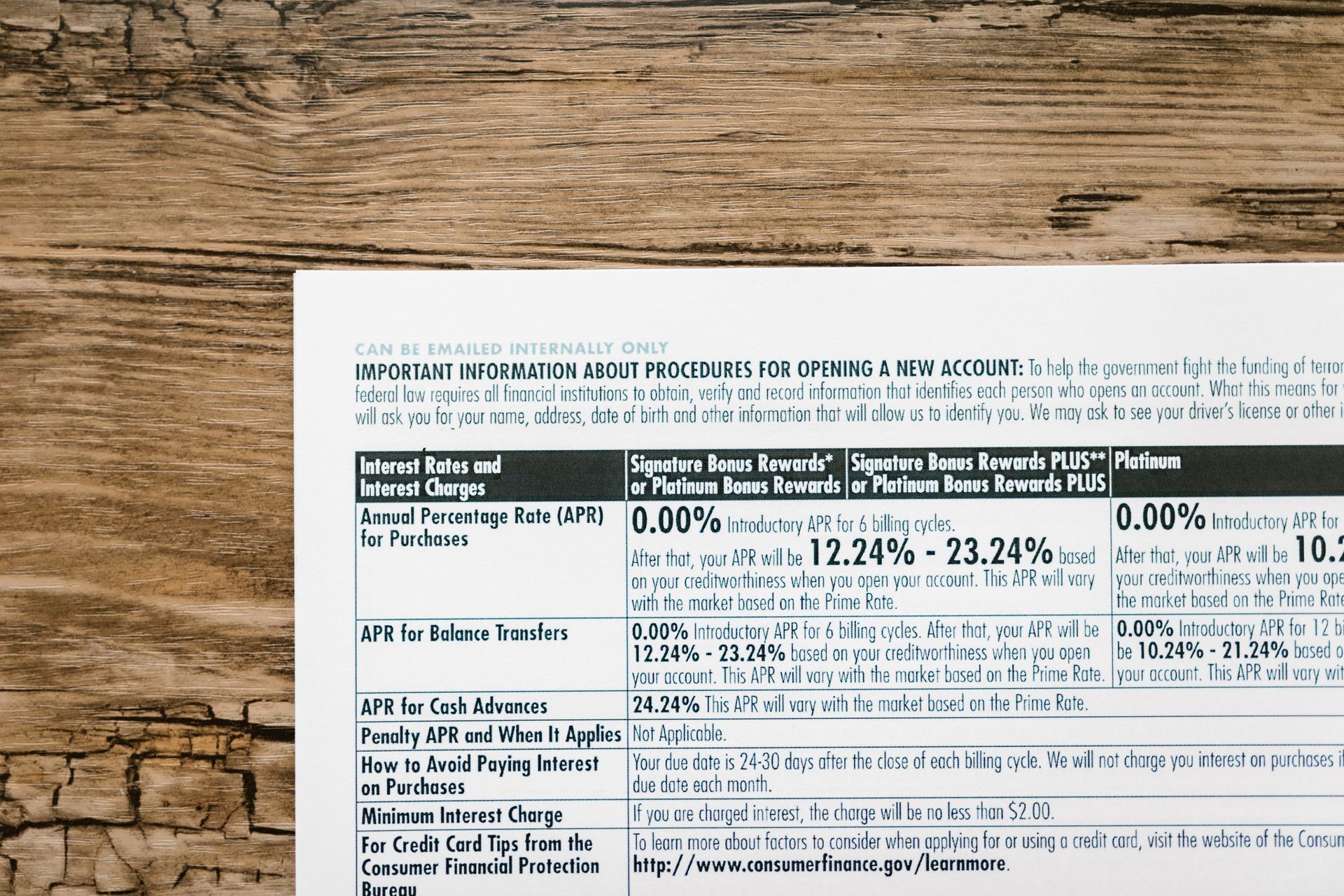

| ROP Insurance Drawbacks | Financial Implications |

|---|---|

| Higher premiums | Cost prohibitive for some individuals |

| Refunds only premiums paid | Lose out on investment growth |

| Lower returns | Loss of potential earnings |

| Potential loss of value | Lose out on growth from other options |

This table illustrates how the financial implications of ROP insurance can lead to a significant loss of value, making it essential to weigh these considerations carefully.

Conclusion

To conclude, Return of Premium (ROP) life insurance policies present several disadvantages that warrant careful consideration. The higher premium costs, coupled with limited investment growth opportunities, make these policies cost-prohibitive for some.

Additionally, early surrender penalties and the rigid structure of these policies can have a substantial impact on financial flexibility and overall value. If you need someone to talk about your insurance inquiries, feel free to send us message for your questions.

Surprisingly, despite these drawbacks, ROP policies remain a popular choice for individuals seeking the security of a guaranteed refund, illustrating the complex trade-offs consumers navigate in financial planning.

Boise Health & Life Insurance Agency - Serving Boise The Treasure Valley & Idaho

Boise, ID

83704

All Rights Reserved | goidahoinsurance.com