Guide to Life Insurance for Diabetics and Tips For Better Health

Giving You Additional Tips On How To Improve Your Life With Diabetic

Chris Antrim CLTC has been helping his clients for over the last twenty years find the most affordable life insurance policies in the market. We work with the nation's top life insurance companies, Prudential, AIG, Banner Life, and John Hancock.

Call today for a quote or review of your current policies and see if we can help you save money! We are nice and will listen to your needs!

Being a diabetic individual means a lifetime taking of medications and treatments. Although there is an underwriting policy for people who have been diagnosed with diabetes, it is important for them to manage their healthy lifestyle to improve their health.

6 Keys To Manage Your Diabetic

The Boise Health & Life Insurance is here to share with you the 6 keys to controlling your diabetes.

- Eat Healthily. This is the most crucial stage for a diabetic person because what you eat can affect your blood sugar. You don’t have to limit your food intake, what you need to do is focus on eating only as much as your body needs. Eat plenty of vegetables, fruits, and whole grains. Choose nonfat dairy and lean meats. Avoid foods with too much sugar and fat. Carbohydrates turn into sugar, try to lessen your carb intake. Try to keep it about the same from meal to meal or much better create your own healthy meals. Eating healthy foods is more important if you take insulin or drugs to keep your blood sugars controlled.

- Exercise. Start a regular exercise. It is better to take at least 30-minutes of activities that can make you sweat and breathe a little harder most days of the week. Regular exercise and an active lifestyle can help you control your diabetes by bringing down your blood sugar. Plus, it can reduce the chances of getting heart disease.

- Get Checkups. Regular check-ups with your doctor can keep your blood sugar controlled. Get a full eye exam every year and get a check for foot ulcers and nerve damage.

- Manage Stress. Stress is the number one enemy of all diseases. When you’re stressed all of your emotions go up, especially your blood sugar levels. Stress also raises the odds of heart disease. Another reason why you should manage your stress is when you’re anxious, you might forget to take your medicine on time, can’t eat right, you skip your regular exercise. To manage your stress, find ways to relieve your stress, like doing your favorite hobbies.

- Stop Smoking. Well, we all know that smoking is an unhealthy habit if you’re a diabetic person you should stop smoking. If you continue doing it face the consequences of getting a health problem even higher and faster.

- Watch Alcohol Intake. It is always easy to control your blood sugars if you also control your beer, wine, and liquor intake. It’s okay to drink but don’t overdo it. Everything that is too much is bad for health. Check your blood sugar when drinking.

Being diabetic is a demanding disease, there are a lot of changes you have to sacrifice in order to maintain low blood sugar. Managing your health can be stressful, but with proper control and discipline yourself, you can take control of your body and your health.

What types of life insurance can a diabetic get?

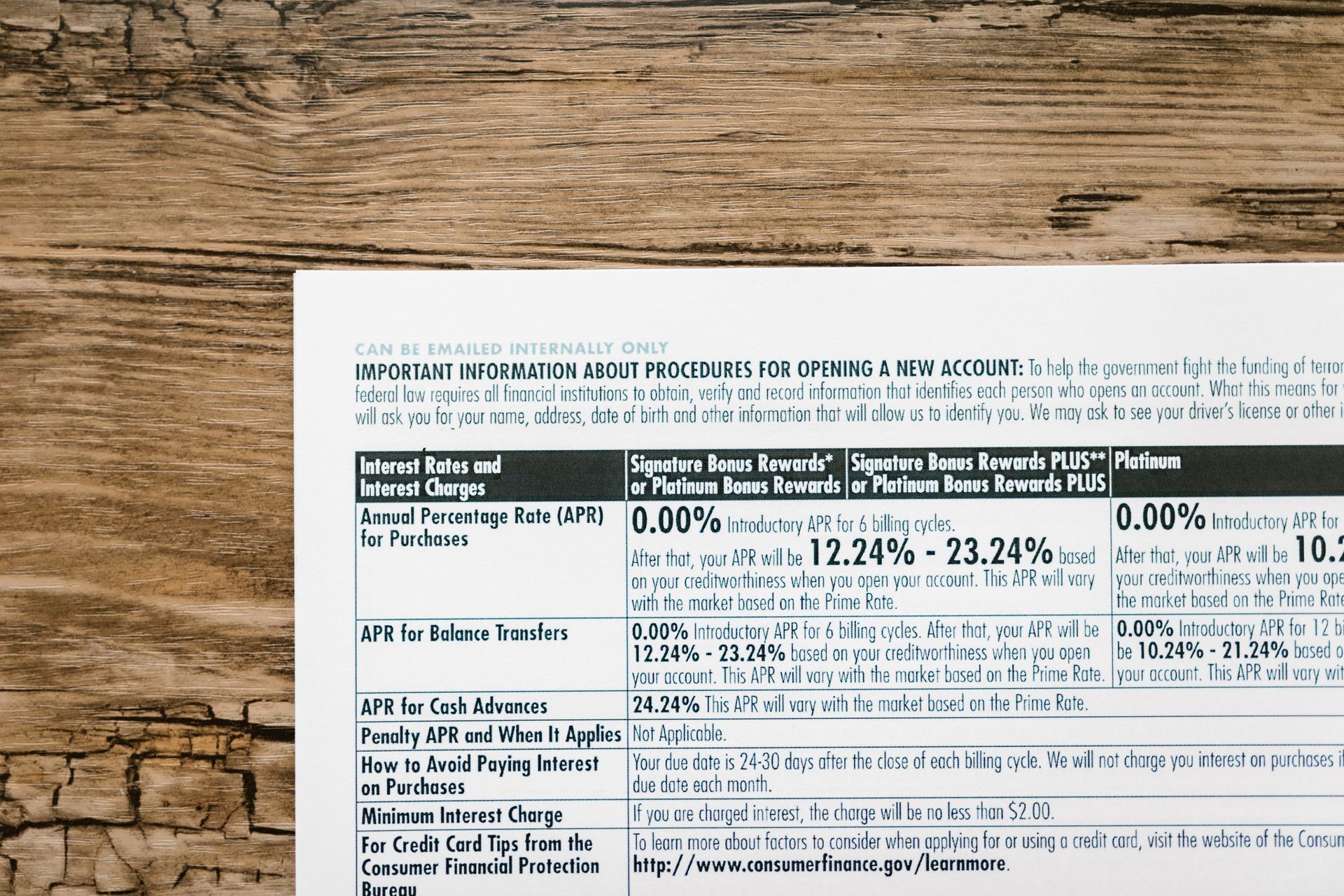

The insurer and your condition determine your life insurance options, so compare quotes to obtain the best coverage. If you're healthy and have controlled diabetes, you may qualify for a standard policy. Other unconventional life insurance policies for diabetics are available.

- Term and permanent diabetic life insurance: If you manage your diabetes successfully, you may qualify for affordable term or permanent life insurance. Whole life and universal life insurance cover you regardless of when you die, whereas term life insurance is cheaper but only covers you for a specific number of years.

- Final expense life insurance: These plans help your family pay for your final medical bills, funeral charges, and other end-of-life expenses. With well-managed diabetes, you can get burial insurance, like term and permanent coverage. Since most people get final expense insurance after 50, it's crucial to keep healthy as you age. If your diabetes is under control, life insurance is cheaper for younger, healthier applicants.

- Simplified issue life insurance: A simplified issue policy allows you apply by completing a health survey and answering medical questions without a medical exam if diabetes limits your conventional life insurance policy selections. A simplified issue insurance may work effectively for healthy diabetics and cost less than a fully underwritten coverage.

- Guaranteed issue life insurance: Guaranteed issue insurance are more expensive and offer less coverage, but your health won't disqualify you. Consider this option if you're older, sick, or have difficulties controlling your diabetes and can't get life insurance.

Factors Influencing Coverage

- Type of Diabetes: Diabetes Type 1 is usually identified in childhood or adolescent and is sometimes seen differently than Type 2 diabetes, which usually appears later in life. When deciding whether to provide coverage, underwriters may evaluate the kind and severity of diabetes.

- Medical History: An in-depth examination of a person's medical history, including any issues stemming from diabetes, is essential to the underwriting procedure. Complications including neuropathy, retinopathy, or cardiovascular problems can affect coverage and cost.

- Control of Blood Sugar Levels: Underwriters closely assess how well diabetes is managed based on variables like as HbA1c levels and adherence to prescription drug regimens. Higher insurance suitability is frequently correlated with improved blood sugar control.

Tips for Finding Affordable Life Insurance

Obtaining life insurance is a critical step in securing financial protection for you and your loved ones. However, for individuals living with diabetes in Idaho, understanding the factors that influence life insurance costs is essential.

- Compare Quotes: Different insurance companies may have varying approaches to underwriting and pricing policies for diabetics. Comparing quotes from multiple insurers can help you find the most cost-effective option.

- Work with an Independent Agent: An independent insurance agent can help navigate the complexities of the insurance market, considering your specific needs and providing access to a range of policies from different carriers.

- Maintain Good Health Habits: Improving overall health can positively impact life insurance costs. Regular exercise, a balanced diet, and adherence to prescribed medications contribute to better insurability.

- Regular Checkups: Consistent medical checkups, including monitoring HbA1c levels, demonstrate responsible diabetes management and may contribute to more favorable insurance rates.

Securing affordable life insurance for individuals with diabetes in Idaho is possible with careful consideration of various factors. By understanding how insurers assess risk and taking proactive steps to manage diabetes and overall health, individuals can enhance their insurability and find coverage that meets their financial needs.

Securing Life Insurance for Diabetic

While obtaining life insurance with diabetes may present challenges, it is not impossible. By understanding the factors that influence coverage, adopting a proactive approach to diabetes management, and exploring different policy options, individuals with diabetes can secure the financial protection they need. Consulting with a knowledgeable insurance agent specializing in diabetes cases can be instrumental in finding the most suitable coverage for individual circumstances. Life insurance remains an essential tool for providing financial security and peace of mind, even in the face of chronic health conditions.

Hope You Enjoy Reading. Thank You!

Boise Health & Life Insurance Agency - Serving Boise The Treasure Valley & Idaho

Boise, ID

83704

All Rights Reserved | goidahoinsurance.com