Emergency Medical Insurance for Immediate Health Protection

In today's uncertain world, unforeseen health emergencies can pose a significant financial burden on individuals. To mitigate this risk and ensure timely access to quality healthcare, emergency medical insurance has emerged as a valuable solution.

This article explores the concept of emergency medical insurance in Idaho, focusing on its ability to provide quick protection for sudden health needs. By alluding to the pressing need for comprehensive coverage and affordable premiums, this article aims to engage an audience that desires belonging within a research-focused and analytical discussion.

Contact Us

We will get back to you as soon as possible.

Please try again later.

The objective tone employed throughout will maintain an impersonal approach while presenting factual information about emergency medical insurance, emphasizing its role in safeguarding individuals' health and well-being.

Ultimately, understanding the benefits of such insurance can empower individuals in Idaho to make informed decisions regarding their healthcare protection, thereby ensuring peace of mind during unexpected health crises.

Key Takeaways

- Comprehensive coverage for unexpected health expenses, including hospital stays, doctor visits, prescriptions, and emergency care.

- Affordable premiums and customizable coverage options to fit different budgets and provide financial security.

- Immediate access to quality healthcare, ensuring prompt treatment, and avoiding delays or complications due to limited resources.

- Protection against financial burden by covering a significant portion or all of hospitalization costs, expensive diagnostic tests, and costly medications, reducing out-of-pocket expenses.

Comprehensive Coverage for Unexpected Health Expenses

Comprehensive coverage provides essential financial protection against unforeseen medical expenses, ensuring that individuals in Idaho are prepared for unexpected health needs. With a variety of coverage options available, individuals can select a plan that suits their specific needs and budget.

These plans typically cover a wide range of services, including hospital stays, doctor visits, prescription medications, and emergency care. The reimbursement process for comprehensive coverage is straightforward and efficient. After receiving medical treatment, policyholders submit their claims to the insurance company along with the necessary documentation.

The insurance company then reviews the claim and reimburses the policyholder for eligible expenses according to the terms of the policy. This ensures that individuals have quick access to funds when they need them most, allowing them to focus on their recovery without worrying about financial burdens.

Affordable Premiums for Peace of Mind

Affordability is a key factor to consider when seeking coverage for unexpected medical expenses in the state of Idaho. It is important to find affordable options that provide peace of mind and financial security. When exploring coverage options, individuals in Idaho can benefit from the following:

- Competitive Premiums: Many insurance providers offer affordable premiums that fit within different budgets. This allows individuals to select a plan that meets their specific needs without breaking the bank.

- Flexible Deductibles: Some insurance plans provide flexibility with deductibles, allowing individuals to choose higher or lower amounts depending on their financial capabilities. This ensures that coverage remains accessible and customizable.

- Cost-sharing Options: Certain plans may also offer cost-sharing options, such as copayments and coinsurance, which can help reduce out-of-pocket expenses for medical services.

By considering these factors, individuals in Idaho can find affordable emergency medical insurance options that provide comprehensive coverage for unexpected health needs while offering a sense of financial security.

Immediate Access to Quality Healthcare

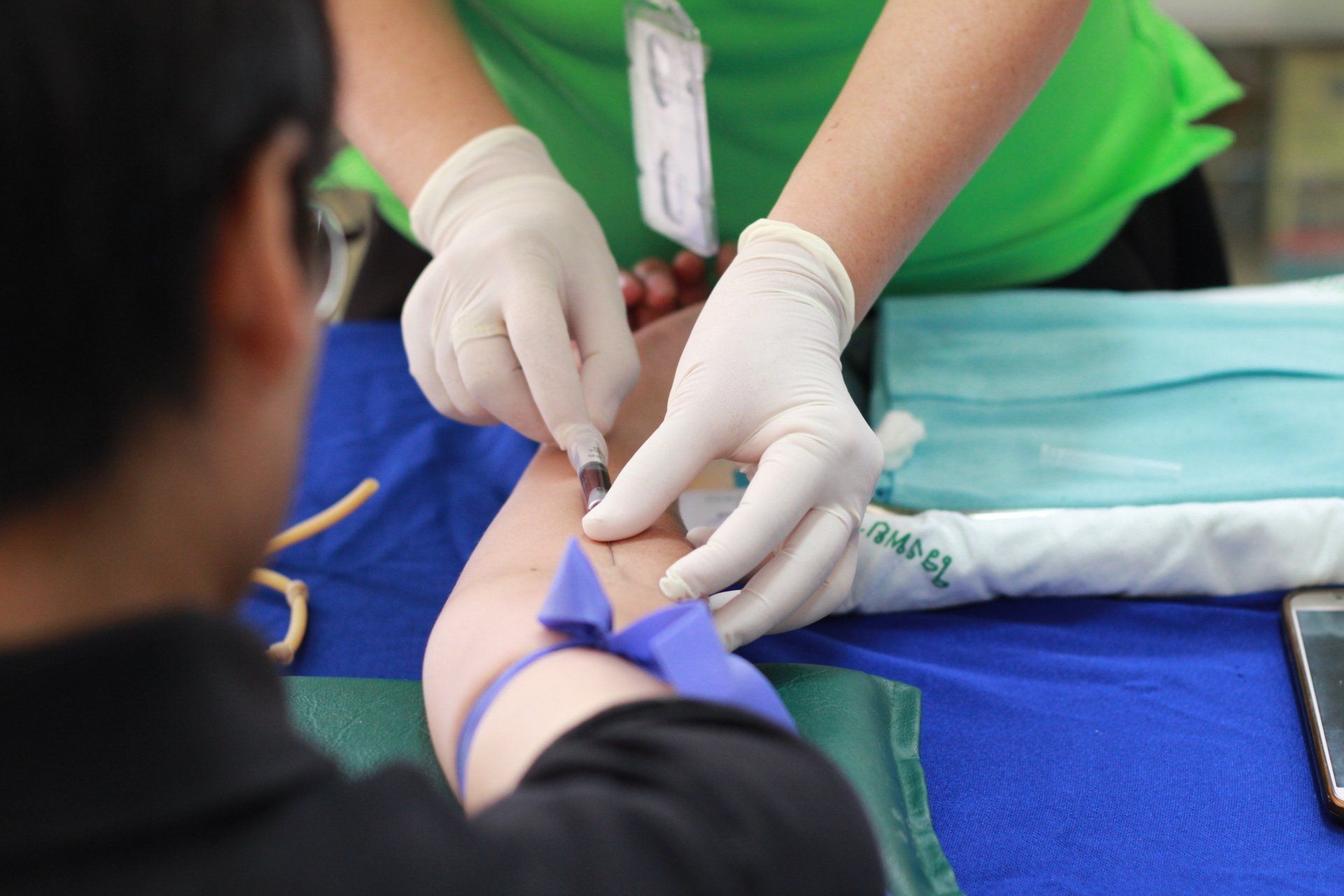

Immediate access to high-quality healthcare is essential for individuals in Idaho, ensuring they receive prompt and exceptional medical services when faced with unexpected health challenges. In emergencies, instant medical assistance can make a significant difference in saving lives and minimizing the impact of injuries or illnesses.

With emergency medical insurance, individuals gain peace of mind knowing that they have quick access to necessary treatment. This type of insurance provides coverage for urgent care, hospitalization, surgeries, and other critical medical needs. It ensures that individuals can receive immediate attention from healthcare professionals without worrying about financial burdens.

By offering quick medical treatment,

emergency medical insurance allows individuals to address their health needs promptly and effectively, avoiding any potential delays or complications that could arise due to limited resources or delayed care. This immediate access to quality healthcare plays a crucial role in safeguarding the well-being of Idaho residents during unforeseen health crises.

Protection Against Financial Burden

One important aspect to consider is the alleviation of financial burdens that individuals may face when seeking necessary medical treatment. Medical emergencies can occur unexpectedly and can result in significant financial strain for individuals and their families. Emergency medical insurance provides a safety net by offering financial assistance during such emergencies, ensuring that individuals can access the medical care they need without worrying about the cost.

To emphasize the importance of this point, the following table illustrates how emergency medical insurance can help alleviate financial burdens:

| Financial Burden | Emergency Medical Insurance Benefits |

|---|---|

| High hospital costs | Covers a significant portion or all of the expenses related to hospitalization |

| Expensive diagnostic tests | Provides coverage for costly diagnostic procedures and laboratory tests |

| Costly medications | Offers reimbursement or direct payment for prescribed medications |

| Out-of-pocket expenses | Helps reduce out-of-pocket expenses such as deductibles and co-pays |

By providing this financial protection, emergency medical insurance enables individuals to focus on their health rather than worrying about the burden of medical expenses.

Securing Your Health and Well-Being

Securing your health and well-being is vital to ensuring a stable and thriving future for yourself and your loved ones. It is important to prioritize preventative care, as it plays a crucial role in maintaining good health. Regular check-ups, vaccinations, and screenings can help detect potential health issues early on, preventing them from developing into more serious conditions.

By understanding your insurance policy, you can ensure that you have access to the necessary medical services without facing financial burden. Learn about the details of your insurance plan's coverage, including information on hospital stays, prescription drugs, and emergency medical services. This knowledge will enable you to make informed decisions about seeking medical attention when needed while minimizing out-of-pocket expenses.

Taking proactive steps towards securing your health not only protects you physically but also contributes to your overall well-being and peace of mind.

Reliable Protection at Emergency Medical Insurance at Chris Antrim Insurance

Emergency medical insurance in Idaho provides comprehensive coverage for unexpected health expenses, ensuring immediate access to quality healthcare without causing a financial burden. With affordable premiums, individuals can secure their health and well-being, gaining peace of mind.

This quick protection serves as a crucial safety net for sudden health needs, offering a sense of security and assurance. By choosing

Chris Antrim emergency medical insurance, individuals can be prepared for unforeseen circumstances and confidently navigate any health challenges that may arise. We cater the entire Boise and the Treasure Valley with the best and affordable insurance.

Boise Health & Life Insurance Agency - Serving Boise The Treasure Valley & Idaho

Boise, ID

83704

All Rights Reserved | goidahoinsurance.com