Idaho Short Term Health Insurance Plans

This is a subtitle for your new post

Hey, Boise, this is Chris again with Boise Health and Life Insurance Agency.

Hey, today we're gonna be talking about short-term health insurance plans from Blue Cross of Idaho. They're one of our top companies here in Idaho. They've been around forever.

If you've had some group coverage for a while, you've probably had some of their plans because they are one of the largest in the state. So the easiest thing to do.

I mean, you come in here, I can talk a little bit about short-term health insurance, and I'll just show you this real quick. Um, up here, you can come to get a quote.

It takes you to the website. But here's their short-term PPO Brochure.

So you can just come in here and you can read this right from the website, look at the deductibles and the plans, and get some good information on what it covers and what they don't cover.

So, um, that's their hope. That can help you out. But you can always call us and ask questions. You know, that's what we're here for. Or you can just click through and you come over here and we'll let me see here.

It's taken a sec here, I see to load. So we're just gonna wait here and Oh, you know what? I'm just going to pause this. What? We do that. So here is where you can come in and you can actually apply for coverage.

Uh, individuals and families, This is the A C. A plan here is their short-term plan, which is usually up to 12 months, and it will take your right in there. Uh, and then the access plan is another plan that will go up to about 36 months on that.

So up here, you can come over here and just individual families, and we'll give you a breakdown where you can find out more information. All right, over here on these plans right here.

The access plans right here. So access plans are underwritten, but they are about 40% lower than the exchanges. So your health, Idaho, and everything.

If you don't qualify for a subsidy with the Department of Health and Welfare, Uh, and if those premiums are just really, really high for you, this might be a great opportunity. You can go up to 36 months.

Blue Cross Of Idaho Access Plans:

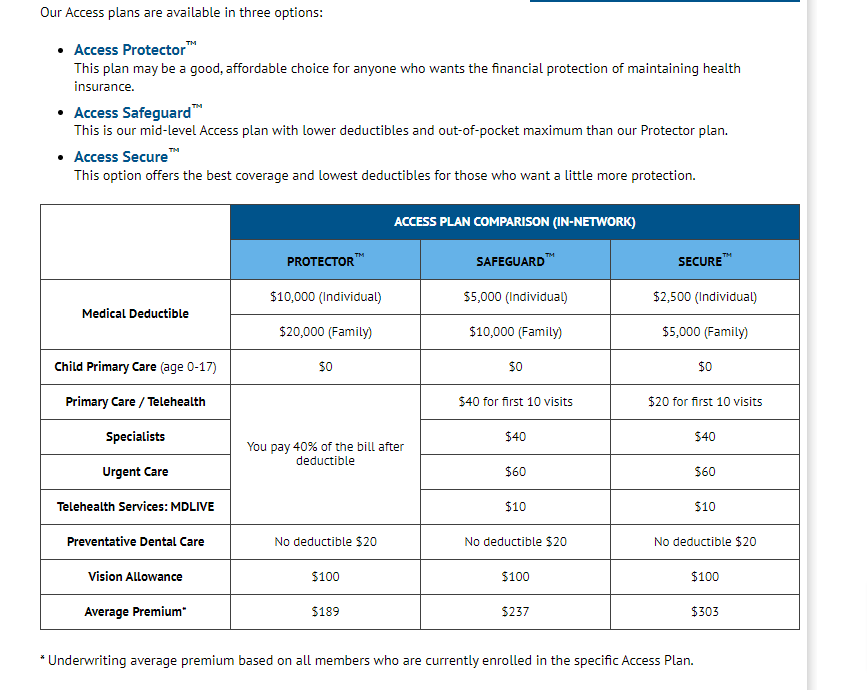

Our Access plans are available in three options:

If you would like to speak with a local, independent agent about your healthcare options, simply click the button below.

Get more information on our Access plans

Ready to get started?

- Access Protector™

This plan may be a good, affordable choice for anyone who wants the financial protection of maintaining health insurance. - Access Safeguard™

This is our mid-level Access plan with lower deductibles and out-of-pocket maximum than our Protector plan. - Access Secure™

This option offers the best coverage and lowest deductibles for those who want a little more protection.

It is not. It is not an A C A plan. Okay, It's a short-term plan, but typically, the premiums are about up to 40% lower. Okay, um, health insurance is very expensive here.

Yes, um, if you do qualify for a qualifying life event and you're eligible to apply for coverage or if you get a subsidy right here is where we can look at that. Open enrollment is not happening right now.

Um, but when it does, we can look at that. And then here's a 12-month plan that we can look at. Um so yep. So available for six-month terms.

Oh, short term. So it looks like it's a six-month term now. So at one point in time, we had 12 months. This is really to fill a gap in between an employer.

Before you either get a new job or go back onto you're waiting for open enrollment for Obamacare or the affordable care act. So there you have it.

There's some good information here, and like the access plans, you can learn more, and you can pull up a brochure and find out about those plans. And here are the three plans here that they have with the deductibles.

And you're now, uh, you don't. They can't give you rates here, because it is, um, they do kind of a kind of underwrite this. So, uh, you know, you go through underwriting first, and then you come back with a rate for you.

Okay? Now, the short-term plan, though, right here. They do have a rate guide on which they have a rate card. So here's the brochure, and let's see which one is the new one here. This is effective 51 So rates are going to change.

So here's the rate card and the Pdf. So here you go. So very simple. They go from $500 deductible, uh, you know, up to a 2004 and looks like this is, uh this is right here.

It guides you through here. So we're just looking here. Monthly rates. When you Okay. 14 months of coverage. 5 to 6. There we go. Okay. Little confusing there.

So, 1 to 4 months of coverage, this is the rate card, and there you go. But anyway, give us a call if you have any questions.

Thank you.