Difference Between Term Life & Whole Life Insurance | Chris Antrim Insurance

What Is Term Life Insurance?

A term policy provides coverage for the insured’s lifetime, and it can be purchased at any age. The premium payments are usually made annually or monthly.

A typical term plan has an initial cash value equal to your annual premiums plus interest. This means that if you die before paying off the full cost of the policy, the remaining balance will go toward funding future benefits.

- Pure life insurance policies are designed to provide protection against loss of income in case of an insured's untimely demise.

- The premium paid by the policyholder remains constant throughout the entire period of the contract and does not increase with age.

- A typical term life insurance plan provides benefits only until the end of the current term. After this time, there may be no further payments made on account of the policy.

How Term Life Insurance Works

A typical term life insurance policy has two parts: an initial premium paid at purchase, and additional premiums paid overtime until the end of the term. The first part of this equation determines how much money will be available to payout upon your death. This amount is called the "death benefit." If you die before the expiration date of the policy, then the remaining portion of the premium payments becomes due immediately.

Example of Term Life Insurance

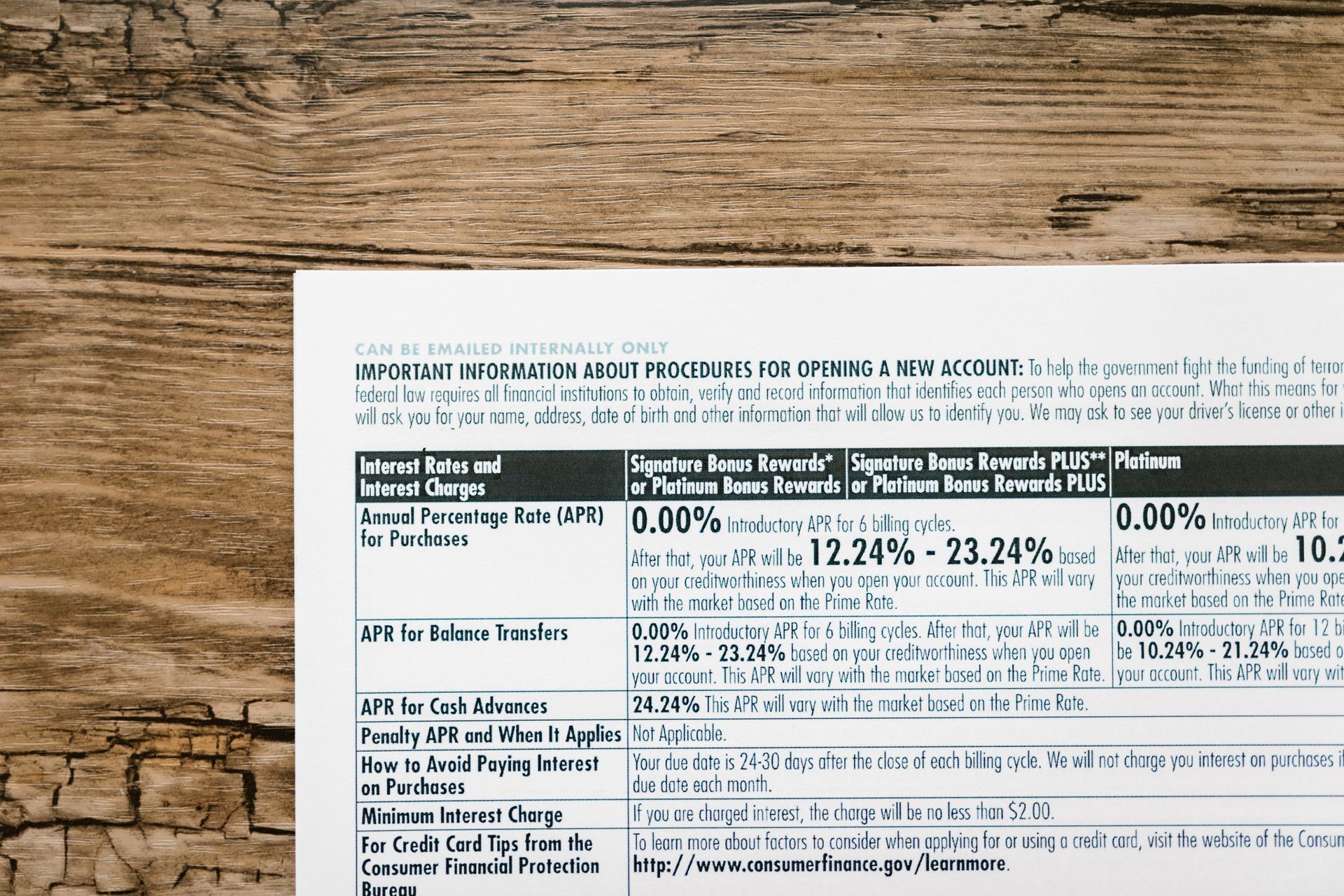

Premiums

A 30-year-old male who smokes one pack of cigarettes daily has an annual income of $50,000. He wants to purchase a 10-year term life insurance policy with a $150,000 face value. His monthly premium payment should be between $15-$25 depending upon his credit rating. If he does not maintain good credit, then his rate could increase up to $35/month.

Look up the insurer's financial strength

Insurance is an investment. The better-rated insurers have lower rates because they offer greater protection at no additional cost. But don't just look at ratings; also check out customer service scores, claims history, and other information before choosing any particular carrier.

Compare Quotes Online

You'll get several estimates based on different assumptions — such as whether you want whole life or universal life.

Term VS. Whole Life: Cost Comparison

Whole-life policies are more expensive because they last for your entire lifetime. But you can buy a term policy that will cover the same amount of time as a whole-life policy at half the cost.

How Long Should I Keep My Health Coverage?

If you have employer group or individual health care coverage through work, you may be able to extend this benefit by enrolling in COBRA.

What Is Whole Life Insurance?

Whole life is the most well-known and simplest form of permanent life insurance, which covers you until you die. A whole life insurance policy pays out over many decades after you've died. You get monthly premiums and build up a cash-like account with interest.

When you pass away, your beneficiary gets all the money inside this account plus whatever was left in the policy. This means you never run out of money even though you may live past 100! The main advantage of whole life insurance is that it builds wealth over time. As long as you keep making regular contributions, you won't ever go broke.

Term VS. Whole Life

Policy Features

and simplest form of permanent life insurance, which covers you until you die. whole life: Policy features matter

If you're shopping for life insurance, here are some things to consider before buying any type of policy:

How much do you need?

A good rule of thumb is to multiply your current salary by two. That gives you enough protection to cover all your expenses should something happen to you.

Do you plan to retire soon?

Term life insurance may not make sense after retirement. Whole life might offer better benefits and lower premiums.

Are You Concerned About Outliving Your Assets? Term VS. Whole Life: Cost Comparison

Whole life insurance can be a better option for some people because of the tax benefits that come with this type of policy. However, term life insurance may offer more flexibility in terms of how you use your money.

What's The Difference Between Term & Whole Life?

The main differences are as follows:

- The cost of whole life policies tends to be higher than those of term plans. This is because they have lower rates on their premiums over time.

How To Choose The Right Policy Between Term Life & Whole Life Insurance

When choosing between term life and whole life insurance, it’s important to consider your individual needs and circumstances. Here are some factors to consider:

- Coverage needs: Determine how much coverage you need and for how long. If you only need coverage for a specific period, such as until your mortgage is paid off or your children are grown, term life insurance may be the best option. If you want lifelong coverage and a savings component, whole life insurance may be the way to go.

- Affordability: Consider how much you can afford to pay for premiums. Term life insurance is generally less expensive than whole life insurance, making it a good option if you’re on a tight budget.

- Investment goals: If you’re looking for a way to build cash value over time, whole life insurance may be a good option. However, if you’re more interested in investing in the stock market or other investment vehicles, term life insurance may be a better choice.

- Health and age: Your age and health can impact the cost and availability of life insurance. If you’re young and healthy, term life insurance may be more affordable. However, if you have pre-existing health conditions or are older, whole life insurance may be a better option.

Who Should Get Term Life Insurance?

Permanent life insurance, which lasts for the rest of your life and comes with a cash value, term life is easy to manage and cost-effective. If you die before the term ends, your beneficiary death benefits protect a tax-free lump sum of money that can be used for funeral costs, to pay bills, or for any other purpose.

Terms usually last from 10 to 30 years and you pay a monthly or annual premium, which is determined using your policy details and your health and demographic information, to keep the policy active. If you're looking for simple, inexpensive

life insurance, then a term policy may be just what you need. You'll have peace of mind knowing that your family has enough time to adjust after losing their breadwinner. And since terms typically last only ten to thirty years, they won't become too expensive to maintain.

Thank You For Dropping By!